import verb – to transfer information from one program to another; sometimes using an Excel or text file.

Are you entering things by hand that you can import into Q7 instead? This month we want to highlight some built-in import tools and how to use them.

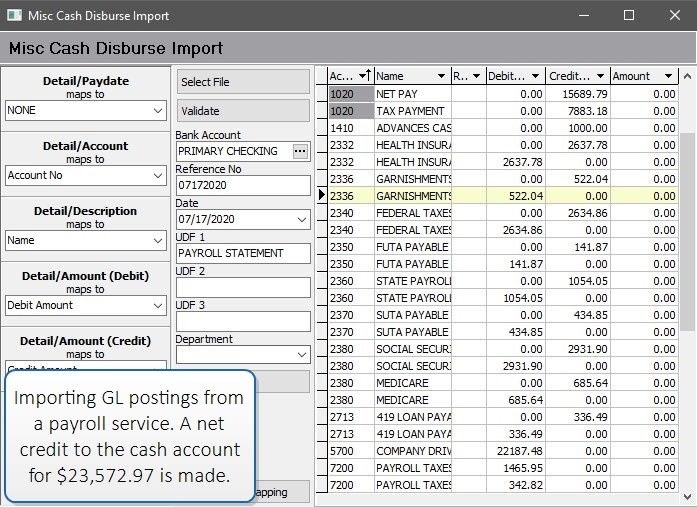

IMPORT GENERAL LEDGER ACCOUNT POSTINGS

Import a list of general ledger account postings. To create a net credit posting to the cash account, select Tools | Misc Cash Disburse Import from the menu in the Misc Cash Disbursements mode of the Checks program. To create a net debit posting to the cash account, select Tools | Misc Cash Receipt Import from the menu in the Misc Cash Receipts mode of the Receipts program. To create a $0 posting to the cash account, use either.

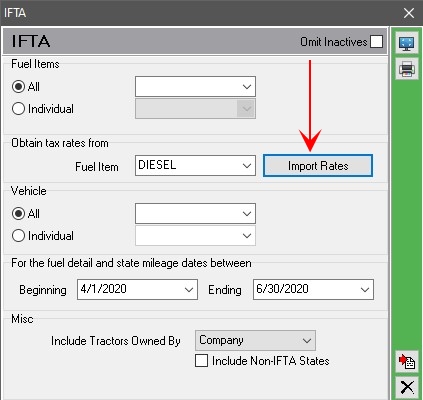

IFTA TAX RATES

Instead of keying in tax rates or manually calculating IFTA, import the current or any previous quarter IFTA tax rates on the spot. Combined with your fuel purchases and tax miles, you’ll have an immediate IFTA report. Reports | Taxes | IFTA. Click the Import Rates button and choose the quarter you want to import.

Search for IFTA in the Knowledge Base for more details.

DOE PRICE INDEX

If you base your fuel surcharge rates on the DOE Price Index, from the Main Menu, select Tools | DOE Price Index. Import current PPG, which can then be used to look up the surcharge rate for a customer.

Search for DOE Price Index in the Knowledge Base for a full guide on how to set up automated fuel surcharge rates based on the DOE Price Index.

YOU JUST SAVED YOURSELF A TON OF TIME!

Technology is supposed to be helpful. Import technology is saving us all time and effort by connecting programs and websites.