The Income Statement, also known as a Profit & Loss (P&L), is a vital tool for understanding your trucking company’s financial health. This report gives you a snapshot of profitability over a specific period of time, and can help you make informed decisions about your operations.

In this article, we’re covering the parts of an Income Statement for a trucking company, exploring key metrics, revenue sources, and expenses.

General Ledger Accounts

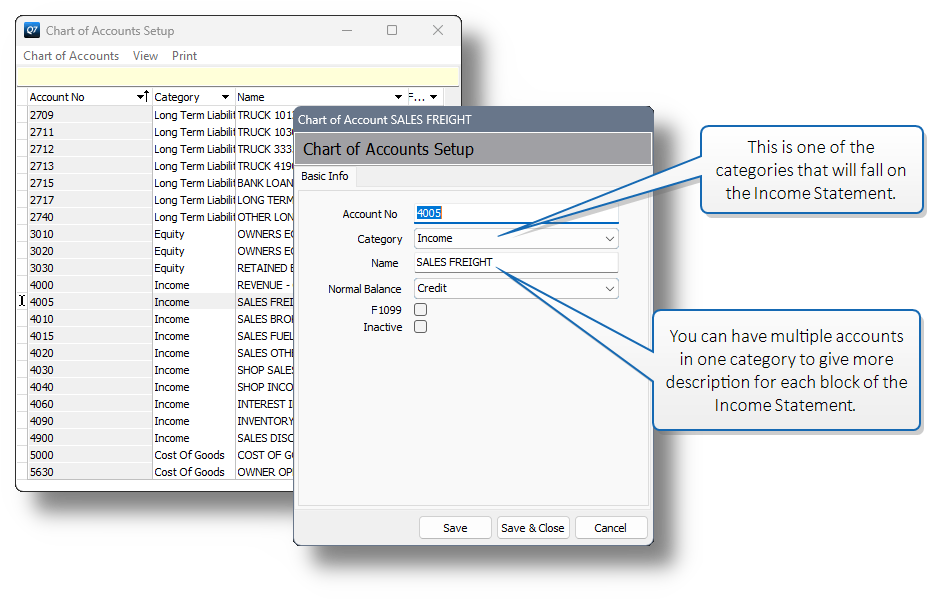

Before we get into the building blocks of the Income Statement, it’s important to understand what each building block contains. Each block of the Income Statement is made up of one or more general ledger accounts. When you create a general ledger account in your trucking software, you’ll get a chance to categorize it.

This determines which block it will fall in on the Income Statement. While there are many different categories of general ledger accounts, only 3 of them will appear on the Income Statement.

In this way, you can break each block down to be more descriptive. Some trucking software will have an additional layer called Items or codes. Each Item or code is assigned to a general ledger account. This gives you the flexibility to assign one single general ledger account (i.e., line haul revenue) to any variety of line haul revenue sources (i.e., mileage billed, tonnage billed, etc.). In this way, you don’t muddy up your Income Statement with too much detail.

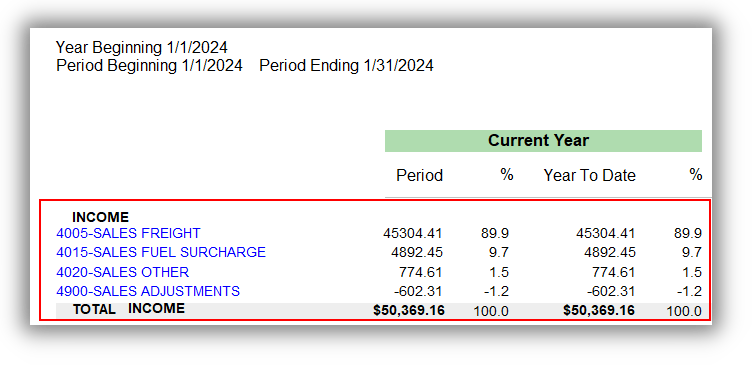

Building Block 1: Revenue

At the heart of the Income Statement is the revenue block. This block outlines the earnings, or income, that were generated by your trucking company’s services. In this case, the revenue primarily stems from transporting goods or cargo from one location to another. Your trucking software should be able to categorize the various streams of revenue automatically while you’re entering your load invoices.

Examples of revenue that would be seen on a trucking company Income Statement:

Freight Revenue – The core earnings generated from transporting goods. In the industry, this is often called the line haul revenue. On the billing level, it’s often calculated based on factors like distance traveled, weight hauled, or the type of cargo.

Accessorial Revenue – You may include additional charges on billed invoices beyond the line haul or freight. Common accessorial revenue streams include fuel surcharge, detention, and even things like TONU (truck ordered, not used). Supplementary services like warehousing charges or expedited shipping could be included in this block, as well. If you have owner operators on your fleet, and you deduct a dispatch fee, then those dollars would be included here, too.

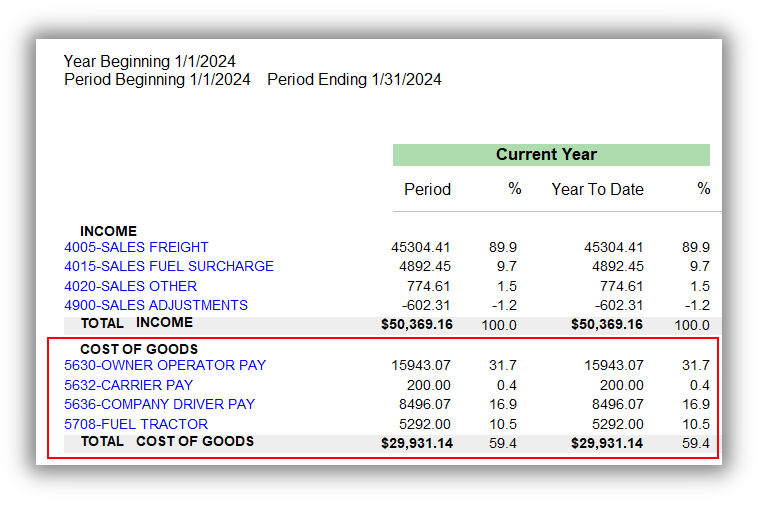

Building Block 2: Cost of Goods

This block contains everything that represents the costs associated with building your revenue block. In the trucking industry, the difference between cost of goods and expenses can become blurry. In general, you want to assign this category to expenses that relate directly to hauling loads, which is your primary source of revenue.

Correctly assigning costs to this category is crucial for determining the profitability of your trucking company, a topic we’ll delve into later.

Examples of costs that would be seen on a trucking company Income Statement in this block:

Driver pay – The backbone of any trucking operation is its drivers. When you produce pay settlements, those costs should be reflected in this block.

Owner Operator or Carrier Pay – If your fleet includes these types of trucks, make sure you include their load pay in this block, too.

Fuel – Fueling a truck is required in order to haul a load and generate revenue. However, your accountant may ask you to put this type of cost in the expense block.

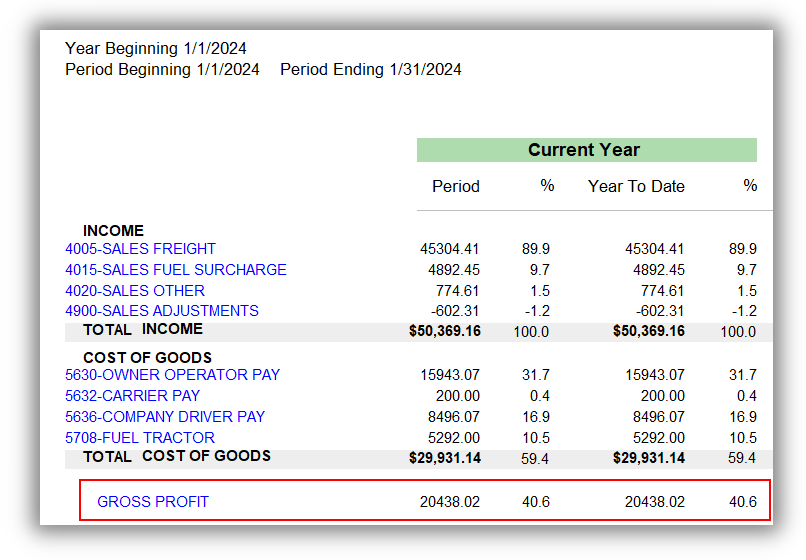

Building Block 3: Gross Profitability Calculations

This block calculates the gross profit by subtracting cost of goods from revenue. It shows how profitable your operation is before overhead expenses. Furthermore, it offers an insight into your ability to generate revenue efficiently.

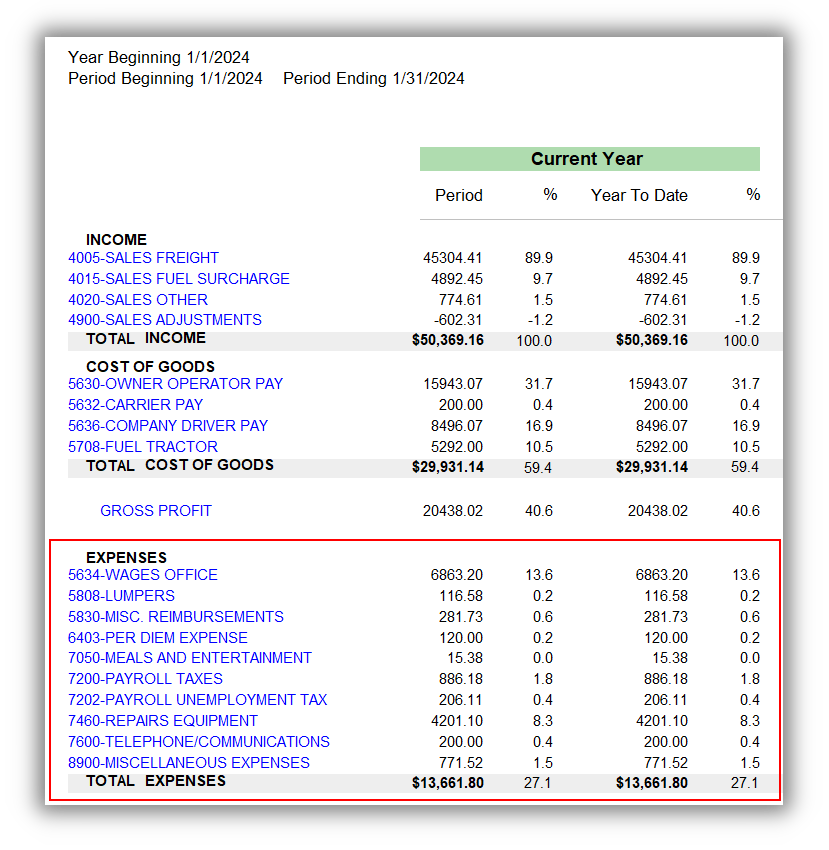

Building Block 4: Expenses

This block contains costs that are necessary in order to run a business. Specifically, these are costs that occur whether or not loads are hauled and revenue is generated. You’ll probably have a large quantity of general ledger accounts in this block, because your CPA will want a description of your overhead expenses.

The expense category comes after the gross profit calculation, because they will be used to determine your overall net income.

Examples of costs that would be seen on a trucking company Income Statement in this block:

Office staff wages – Dispatcher and general administration. These people are critical to your operation, but you will pay them whether or not your trucks are moving loads.

Payroll taxes – Always assign the expense category to the employer expenses. Your trucking software should calculate payroll taxes automatically.

Telephone and internet – All of your utilities should be assigned to this category.

Insurance Premiums – Insurance premiums on your trucks or other equipment occur regardless of whether you’re hauling loads and generating revenue. We can also consider employer related insurance premiums as an expense.

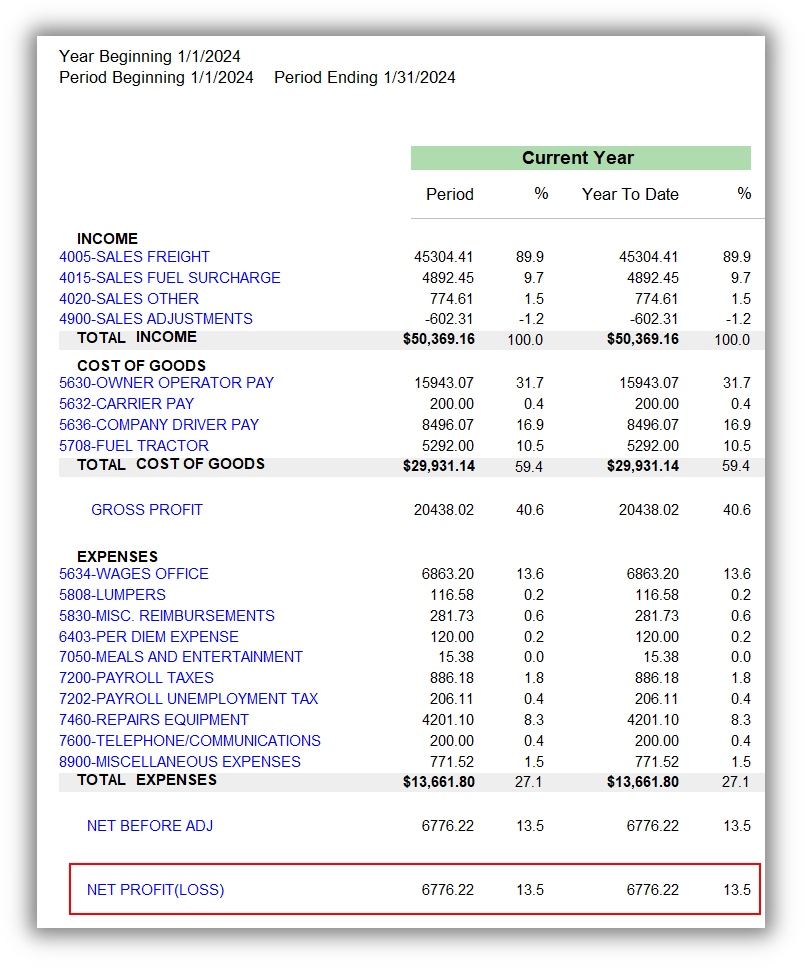

Net Profit

The final figure is the net profit, and it represents your operation’s bottom line. This number encompasses all of the blocks we just covered. Understanding and monitoring this number is essential for evaluating your trucking company’s overall performance during that period of time. Your trucking software Income Statement report should include a comparison between the figure from the previous year.