QuickBooks is a household name, so it needs no introduction. Can it be used to effectively run a trucking company? In this article, we’ll explore using QuickBooks as your primary accounting software for a trucking company.

QuickBooks Has All The Basic Business Requirements

QuickBooks, in some ways, sets the standard for business accounting software. It offers payroll processing, accounts receivable invoicing, bill payment, credit card processing, and more. It fulfills all the requirements for running a business. Starting with QuickBooks is relatively easy, thanks to numerous online resources. Additionally, if you have experience with accounting software, learning your daily accounting tasks will be intuitive.

The Problem With a “One Size Fits All” Software

QuickBooks is designed for everyone. It has to work for a shoe store or an electrician the same way it has to work for your trucking company. Features that are specific to trucking companies, like dispatching and producing cost per mile reports, are pointless for most other businesses. That means that those features will never be added.

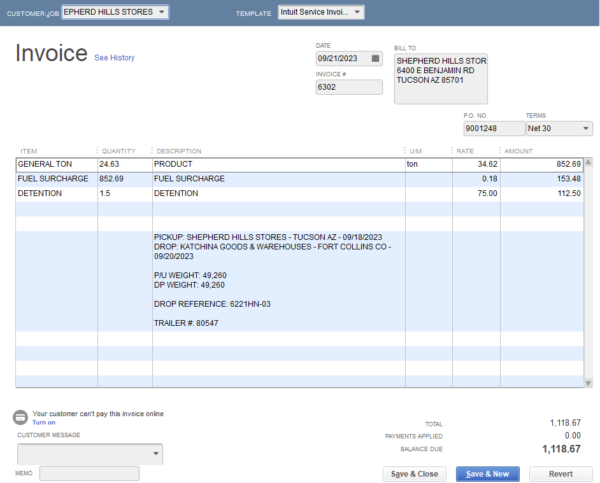

Let’s take billing a load as an example. Shippers usually want to see billable stop details, like pickup weight and drop weight. In QuickBooks, you have to key in all of the stop details by hand using a plain text field. If you have a high volume of loads, that could become tedious.

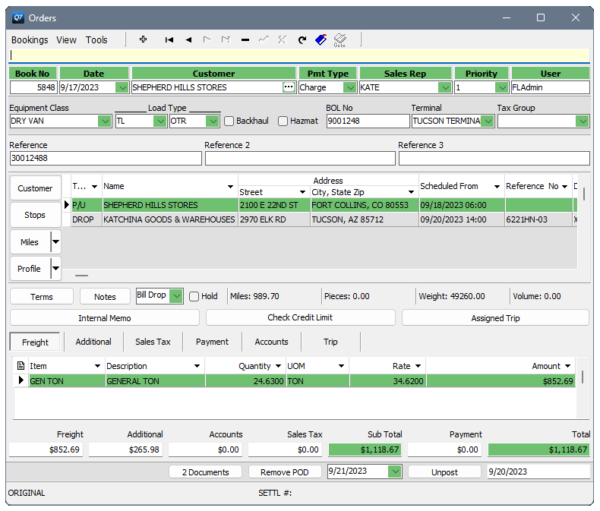

Entering an invoice in trucking accounting software is going to look different. There will be dedicated fields for all of the details that you need to convey to the shipper that you’re billing. In addition, the software will allow you to attach supporting paperwork, like the bill of lading, to the invoice.

QuickBooks is fine for paying regular operating expenses, but it can’t produce a pay settlement containing load details for your drivers. You’ll have to manage your detailed pay settlements and dispatch in Excel or some other program.

Why Would a Trucking Company Use QuickBooks?

QuickBooks can serve a purpose in a trucking company. Smaller trucking companies that are still growing can use QuickBooks to meet the basic bookkeeping requirements, and use Excel for anything else. Or, you may have found a way to make it work. In this case, you already know what’s missing from QuickBooks, and you’re okay with it.

Another reason you might use QuickBooks as a trucking company is if your accountant only knows how to use QuickBooks. Most, if not all, trucking accounting software platforms will have the same dual entry general ledger accounting specifications that QuickBooks has. However, some accountants only learned how to use QuickBooks, so they would prefer to look over your books that way.

What Are You Missing Out On?

As we’ve already covered, QuickBooks won’t have many of the necessary features for a trucking company. That means that you’re missing out on simply integrating your accounting with your day-to-day operations. For example, booking a load for dispatch can double as your invoice. Producing a pay settlement can double as your payroll expense postings. Recording a service on a truck can produce in-house costs or over the road expenses.

You’ll also have difficulty finding trucking-specific reports in QuickBooks, such as a load profit analysis. Trucking software includes built-in reports for calculating costs per driver or per load. When using QuickBooks, you may need to manually combine your data to analyze it according to your preferences.

Fuel taxes are a requirement when you run a trucking company. Keeping your fuel and mileage data under the same roof as your accounting software is far more efficient than managing everything in two or more places. Trucking software will be able to produce an IFTA report for you using your fuel and mileage data.

What About a QuickBooks Integration?

You can absolutely use two pieces of software, but one is always better when it comes to running a business. However, trucking software that integrates with QuickBooks accounting can make everyone happy. Book loads, dispatch, and produce pay settlements in trucking software, and pass the data over to QuickBooks for the accounting.

Conclusion

Using QuickBooks as your main accounting platform as a trucking company can be done, but it won’t be easy. Having your accounting in the same software as your dispatch, maintenance, and fuel taxes is preferred for most trucking companies. Contact us for a free demonstration of Q7 Trucking Accounting Software.